Pension and Health Plans Changes

Periodically, the Directors Guild of America-Producer Pension and Health Plans updates its benefit terms. The information below reflects recent changes and provides important details that impact all participants. For a full list of changes and updates, refer to the March 2020 Health Plan Summary Plan Description and the March 2020 Pension Plans Summary Plan Description and their updates, available at www.dgaplans.org/forms.

- All-Inclusive Out-of-pocket Limit Increase

- CVS Caremark Updates Its List of Covered Medications

- Minimum Required Earnings for Health Plan Coverage Increases to $37,925

- Updated IRS Tax Form W-4P Required for All Monthly Payees from the Basic Pension Plan

- Required Beginning Date Increases to Age 72

- One-Year Deferment Option for Supplemental Loan Repayments Formalized

Health Plan Changes

-

All-Inclusive Out-of-Pocket Limits Increase Effective January 1, 2023 as Established Under the Affordable Care Act

The All-Inclusive Network Out-of-Pocket Limit sets a maximum on the amount you pay out-of-pocket per calendar year for network benefits, including deductibles, co-insurance and co-payments (such as prescription drug co-payments, the $50 emergency room co-payment and the $10 co-payment for visits to the UCLA/MPTF health centers). The Health Plan indexes this limit annually, in line with the amount established each year under the Affordable Care Act.

Accordingly, beginning January 1, 2023, the Health Plan’s All-Inclusive Network Out-of-Pocket Limit will increase from $8,700 individual/$17,400 family to $9,100 individual/$18,200 family for all coverage plans. If you reach the limit, the Health Plan will pay 100% of covered network expenses.

-

CVS Caremark Updates Its List of Covered Medications, Effective January 1, 2023

CVS Caremark, the Health Plan’s prescription drug benefit manager, periodically reviews its list of covered medications, called the Advanced Control Formulary, to ensure access to safe, effective treatments in all drug classes. Changes to the formulary affect which medications are covered by the Health Plan and how much you pay out-of-pocket for prescriptions.

Effective January 1, 2023, CVS Caremark is revising its list of covered medications in its formulary. If you are currently taking a medication that will be excluded from the revised formulary, CVS Caremark should have already mailed you a letter with information on alternatives. If you are taking a maintenance medication, be sure to review the new list in case the status of your medication has changed. The complete 2023 list of excluded medications along with preferred alternatives is available at www.caremark.com/portal/asset/DirectorsGuild_AdvancedControlFormulary.pdf.

-

Minimum Required Earnings for Health Plan Coverage Increases to $37,925, Effective January 1, 2023

Effective with earnings periods beginning on or after January 1, 2023, the minimum earnings required to qualify for Health Plan benefits will increase to $37,925 for the DGA Choice Plan and $123,000 for the DGA Premier Choice Plan. These adjustments align the Health Plan’s minimum earnings threshold for coverage with the wage increases negotiated by the DGA in its Collective Bargaining Agreements.

Under the new threshold, to qualify for benefits under the Choice Plan, you must earn a minimum of $37,925 during any 12-month earnings period beginning January 1, April 1, July 1 or October 1 in 2023. Only allowable earnings covered under each Bargaining Agreement are counted toward the earnings threshold.

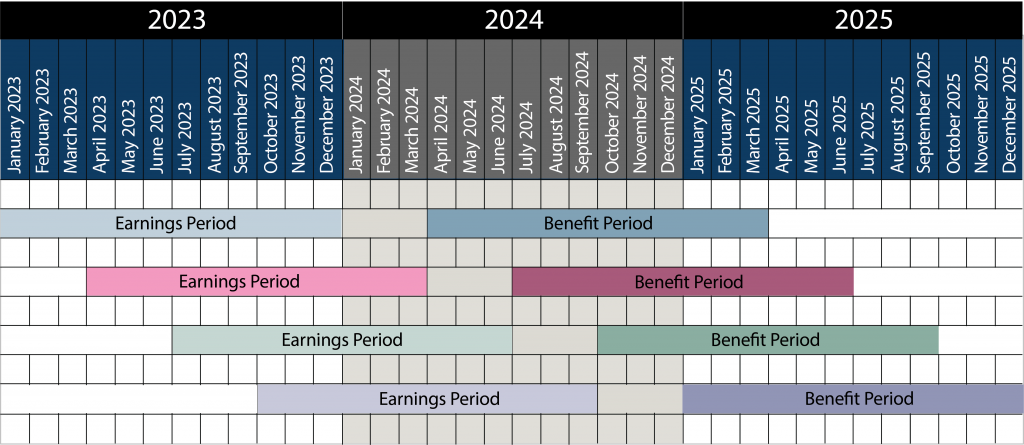

Earnings and Benefit Periods 2023-2025

Effective with earnings periods beginning on or after January 1, 2023, the minimum earnings required to qualify for Health Plan benefits will increase to $37,925 for the DGA Choice Plan and $123,000 for the DGA Premier Choice Plan. The chart below reflects the related earnings and benefit periods.

Pension Plan Changes

-

Pension Plans Amended to Codify One-Year Deferment Option Already in Effect for Supplemental Plan Loan Repayments

To assist participants experiencing financial hardship during the COVID-19 pandemic, the Board of Trustees amended the Supplemental Plan to temporarily allow participants to apply for loans from their account balance. These loans were allowed from May 1, 2020 to December 31, 2020, with full repayment to be made within a maximum of five years.

Soon after the Board’s provision of loans from the Supplemental Plan, the Coronavirus Aid, Relief and Economic Security (“CARES”) Act of 2020 offered additional relief that plans could adopt, including the option to allow “qualified individuals” to suspend loan repayments for up to one year. The Board of Trustees immediately exercised this option and amended the terms of the Supplemental Plan loans to allow deferment of up to one year of repayments for qualified individuals.

The Board of Trustees recently passed an amendment to formalize the change.

-

Updated IRS Tax Form W-4P Required for all Monthly Payees from the Basic Pension Plan

The IRS recently released the 2022 IRS Form W-4P, which is the federal tax Withholding Certificate for Periodic Pension or Annuity Payments. All Basic Plan monthly benefit payees must use the new form to indicate the amount they would like withheld from their monthly benefit for federal income taxes. The Pension Plans are required to switch to the new Form W-4P for monthly payments made on or after January 1, 2023.

If you currently receive a monthly benefit payment from the DGA-Producer Basic Pension Plan and have not submitted a new Form W-4P to the Plans’ office, go to www.dgaplans.org/2022-irs-form-w-4p-notice/ to download the form along with details on why it is being required.

-

Required Beginning Date Increases from Age 70½ to 72

Under the Internal Revenue Code, all qualified retirement plans, such as the DGA-Producer Pension Plans, must make “required minimum distributions” to participants who have reached their “required beginning date.” Under the Pension Plans, the required beginning date is the April 1 of the year following the year you reach age 70½.

As part of the SECURE Act of 2019, the Required Beginning Date was increased from age 70½ to 72, allowing participants to wait until April 1 of the year following the year they reach age 72 before they must begin receiving required minimum distributions from the Pension Plans. The Plans have been operating in accordance with the required change for all required minimum distributions made on or after January 1, 2020.