How to Read Your Explanation of Benefits

The statement you receive from the Health Plan after each visit to your doctor is the best way to ensure you pay only what you should.

After you go to the doctor, the Health Plan will send you a statement of how your benefits were applied to that visit, including the amount charged by your doctor, the amount paid by the Health Plan and the amount you can expect your doctor to bill you. This statement is called the Explanation of Benefits, or EOB. The EOB provides important information you can use to guard against billing errors and medical fraud, as well as track your medical spending. Understanding your EOBs is an essential part of staying informed about your healthcare.

EOBs are not bills. The EOB’s Patient Responsibility section, however, indicates the amount you can expect to be charged by your provider. If there is an amount indicated in the Patient Responsibility section, wait until your doctor’s office sends you an invoice before submitting payment.

HOW TO READ YOUR EOBs

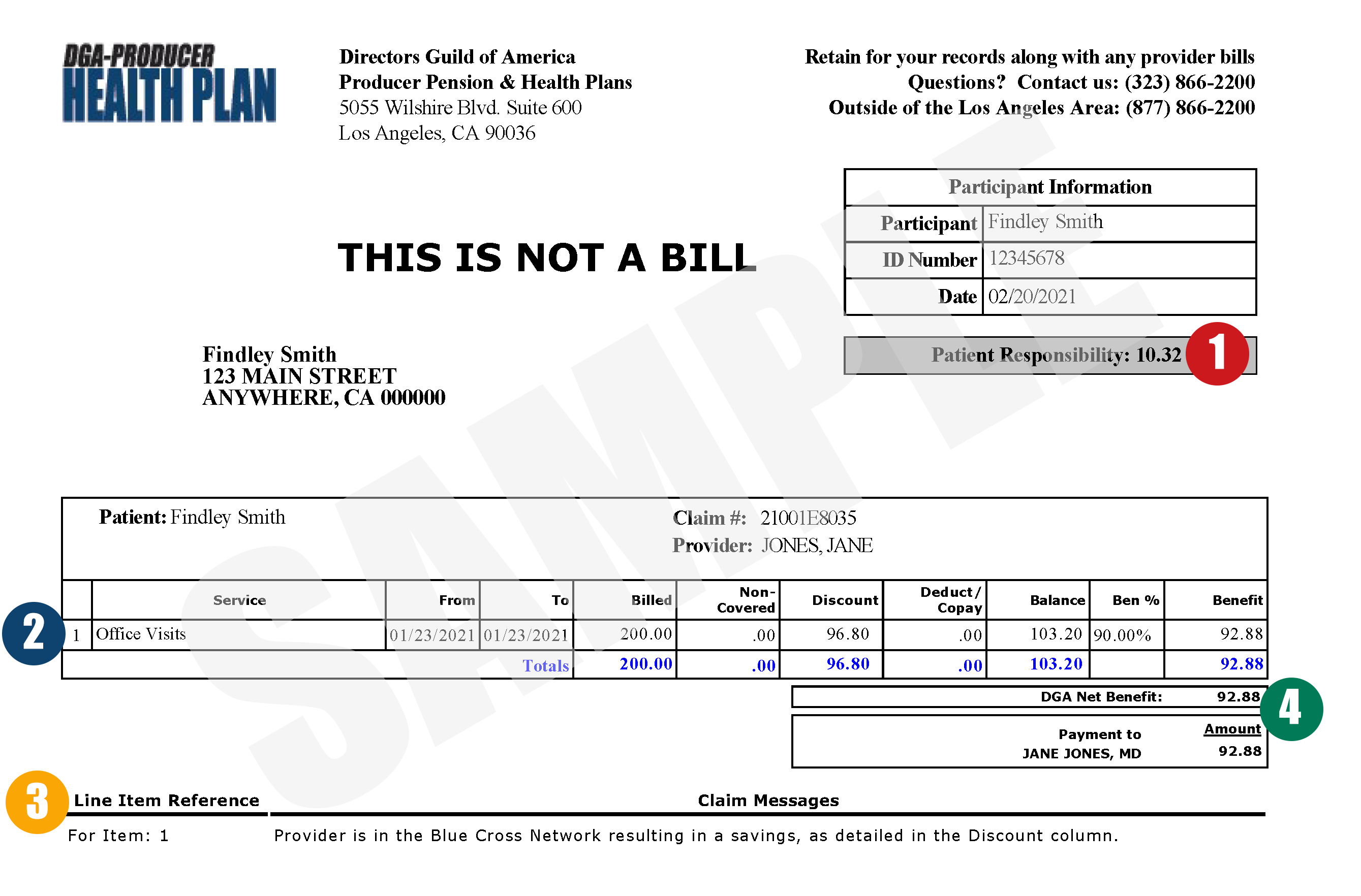

The sample below notes the most important sections of your EOB.

- Patient Responsibility: This amount represents what could be your out-of-pocket responsibility to the provider of service (hospital/doctor). In the sample above, the patient, under normal circumstances, could expect a bill from their provider in the amount of $10.32, matching the amount listed in the Patient Responsibility section.

In certain instances, however, a $0 Patient Responsibility will not necessarily mean no out-of-pocket costs related to the services listed. If additional information is needed before your claim can be fully processed, your EOB may show a $0 Patient Responsibility until the requested information is received and processed by the Health Plan. For this reason, it is very important to always check your EOB’s Claim Messages (explained in item #3 below) to ensure they do not indicate an issue with the claim that might affect the amount listed in the Patient Responsibility section, such as more information being needed before the claim can be fully processed.

Otherwise, if the amount on your EOB does not match the bill from your provider or if you get the bill from the provider before you receive your EOB, call the Health Plan at (877) 866-2200, ext. 401. - Claim/Benefits Information: This section lists the following details about your claim and how your benefits were applied:

-

- Service: a brief description of the service you received

- From/To: the dates the services were provided

- Billed: the amount billed by the provider

- Non-Covered: the amount of the billed charges that is not covered by the Health Plan, such as any amount over the Health Plan’s allowed amount for that service

- Discount: the applicable Anthem Blue Cross negotiated network discount

- Deduct/Copay: the portion of the allowed amount you are responsible for either as your co-pay or deductible

- Balance: the remaining allowable charges after all deductions (Billed – Non-Covered – Discount – Deduct/Copay = Balance)

- Ben%: the percentage portion covered by the Health Plan. This percentage varies by type of service, your coverage plan and whether you have reached your annual out-of-pocket maximum

- Benefit: the dollar amount of the percentage portion covered by the Health Plan (Balance x Ben% = Benefit)

- Claim Messages: This section lists special messages from the Health Plan. Each message will reference a specific line or lines of the EOB. These messages could include information about discounts applied (as in the sample), requests for additional information, explanations for why an item was not covered, etc.

If a Claim Message indicates that additional information is requested, it is important the information is provided to the Health Plan in a timely manner, as any requested information submitted to the Health Plan more than 180 days from the date of the EOB will be denied per Health Plan rules. If you are unsure what information is required, contact the Health Plan’s Participant Services Department at (877) 866-2200, ext. 401 for further assistance.

- Total Benefit/Payment Information: This section indicates the dollar amount the Health Plan paid and where payment was sent. If your provider billed the Health Plan directly for their services, the Health Plan will make a payment to the provider, the amount of which will be indicated on your EOB (as in the sample).

If you paid the provider in full at the time of service, a check payable from the Health Plan to you will be attached to your EOB.

HOW TO USE YOUR EOBs

You can use your EOBs for a number of purposes:

Anticipate your bill and verify its accuracy. The bill you receive from your doctor should never be higher than the Patient Responsibility amount on your EOB, provided all information required to process the claim has been submitted. If your claim has been denied for any reason (refer to the Claims Messages section for this information), your provider may bill you for the services. In this case, make sure you provide the Health Plan with all requested information so that your claim can be fully processed and the Health Plan may make payment as appropriate.

As you compare your EOB to the bill from your provider, some questions you should ask include:

- Is the service listed accurately? For example, you should not be charged for X-rays when your office visit did not include X-rays.

- Is the Health Plan sending payment to the correct party? Most claims are paid to the provider, but if you paid the provider in full at the time of service, payment will most likely be made directly to you. Keep in mind that for certain services or procedures, such as labs or treatments performed in a hospital setting, you may not recognize the providers listed on your EOB as you may not have directly interacted with them. For example, surgeries typically involve not only the surgeon, but an anesthesiologist, a lab technician and other personnel whose charges may appear on your EOB. If you have any questions about the parties receiving payment from the Health Plan, please call Participant Services.

Track your medical spending. EOBs are an easy way to track the status of your annual deductible or to keep track of your out-of-pocket costs for the year. If you receive services through the Health Plan’s PPO network, Anthem Blue Cross, you may also track your medical spending through the Plans’ myPHP portal at myphp.dgaplans.org, Anthem’s portal at anthem.com, or Anthem Anywhere phone app. These tools will allow you to easily view your claims and progress toward meeting your deductible.

In conclusion, careful reading of your EOBs is a key part of staying informed of your healthcare expenses. To be sure you are not being overcharged, match your EOB with your bill BEFORE submitting payment to your provider. This can help you catch any errors before you send payment. If you ever have questions about an EOB or the answer to any of the questions listed above is “no”, contact Participant Services at (877) 866-2200, ext. 401.