IMPORTANT HEALTH COVERAGE TAX DOCUMENTS

If you and your dependents were covered by the Directors Guild of America – Producer Health Plan (the “Plan”) in prior years, you likely received a tax form from the Plan confirming the months of enrollment for you and your dependents (labeled the Form 1095-B). The purpose of this Form was to provide you with proof that you were enrolled in health insurance and satisfied your obligation under the Individual Shared Responsibility requirements (commonly referred to as the “individual mandate”).

Effective January 1, 2019, Congress eliminated the individual penalty for failure to maintain health insurance coverage. As such, the IRS has determined that the Form 1095-B no longer needs to be distributed to Health Plan participants. The Form 1095-B is not required as part of your annual tax filing. In accordance with these guidelines, you will not receive a Form 1095-B from the Plan for the 2023 tax year unless you request a copy.

Forms will be available by request beginning no sooner than March 2, 2024. For general questions related to the Affordable Care Act (“ACA”) or to request a copy of the Form 1095-B, please send your request, including your name and Plan ID number, to ACAquestions@dgaplans.org or click the button below.

*By clicking the link above and indicating “digital copy,” you consent to receiving your Form 1095-B electronically.

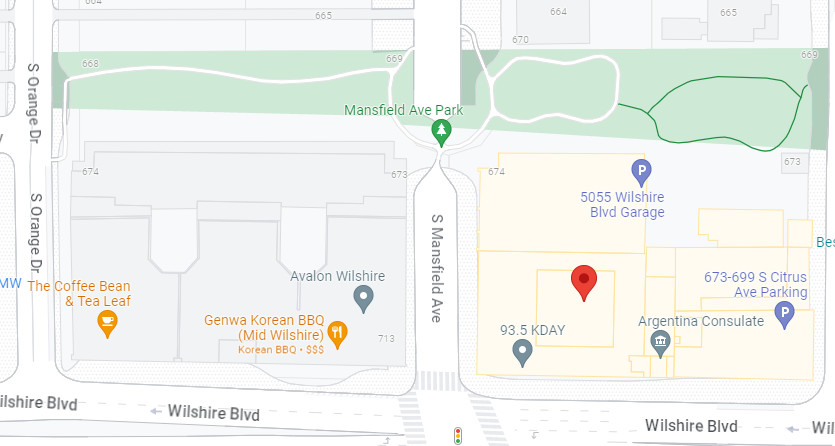

Written requests may be mailed to:

Directors Guild of America-Producer Pension and Health Plans

ATTN: Eligibility Department

5055 Wilshire Boulevard, Suite 600

Los Angeles, CA 90036

You may also make your request by phone by calling (323) 866-2200, Ext. 502. Please allow up to 30 days from receipt (or, if later, 30 days from March 2, 2024) for your request to be processed.

If you have any questions about this Form or the Plan’s reporting obligations, please contact Participant Services at (323) 866-2200, Ext. 401 or toll free at (877) 866-2200, Ext. 401.